EXCISE TAX STAMP

The Tax Reform Act of 1997 (Republic Act No. 8424, as Amended) mandates the Bureau of Internal Revenue (BIR) to implement internal revenue stamps. In addition to this, the Philippine government is committed to complying with the provisions of the WHO Framework Convention on Tobacco Control Protocol.

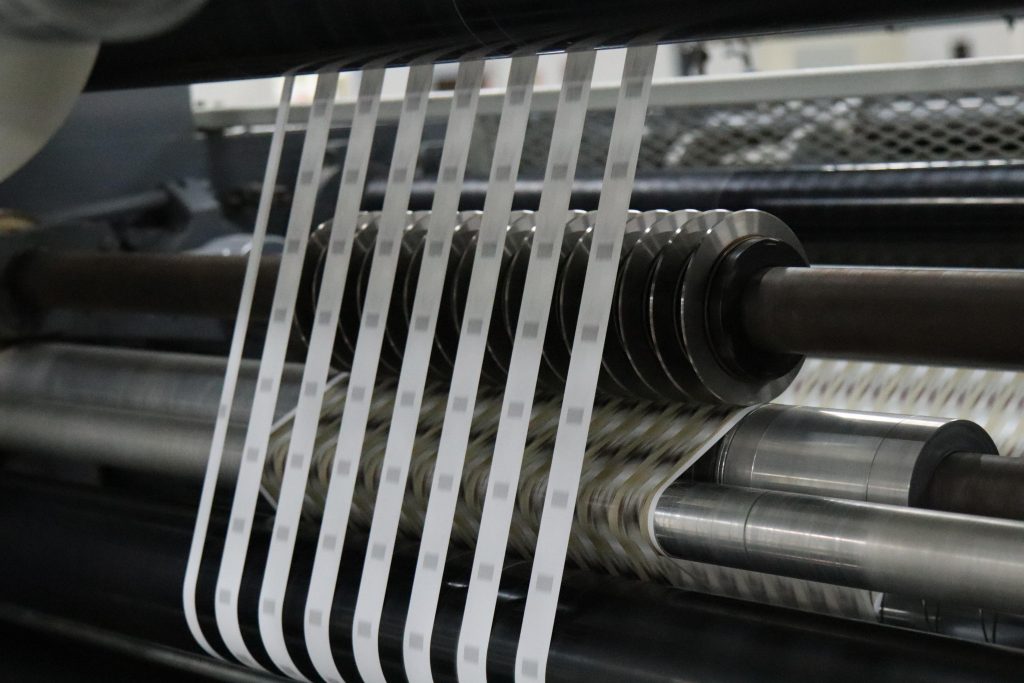

APO Production Unit, Inc. took the challenge of revolutionizing the excise tax stamp to meet the National Government’s and its agencies’ requirements for highly sensitive security printing services. The Philippine Excise Tax Stamp is more than a mere stamp; it is an innovative world-class solution that integrates ordering, production, distribution, affixing, and tracking internal revenue stamps at efficiently high production speeds. Due to the stamp’s functional design and non-intrusive nature, the taxpayers readily adopted its use, resulting in increased effectivity, security, and profitability.

Since September 2014, APO has provided the BIR with the Internal Revenue Stamp Integrated System (IRSIS). This end-to-end web-based solution manages the ordering, production, distribution, affixing, and tracking of internal revenue stamps.

- Ordering – IRSIS interfaces with the government’s excise tax system, which accepts online orders of tax stamps and payments of excise taxes from cigarette manufacturers. The online ordering mechanism allows taxpayers to specify multiple tax classes per order, and the taxpayers’ desired format, such as pre-cut, rolls, or sheets.

- Tax verification – Upon order of stamps by the Taxpayer, the system validates excise tax payment through the BIR’s electronic filing and payment system (eFPS). It communicates the order information to APO on-demand.

- Unique identifier codes (UIC) – The system then generates encoding information for each stamp’s encrypted QR code and UIC.

- Track & trace system – the system will monitor the status of stamps – from encoding, slitting, packaging, releasing to the Taxpayer, affixing to specific brands of cigarette packs, and removals of cigarettes from the Taxpayer’s production plant for warehouse or sale.

- Inspector-level authentication – IRSIS uses customized mobile applications installed on authorized mobile verification devices to verify and display stamp information (e.g., manufacturer name, UIC, place/location of production of cigarettes, tax class, intended market, date of order of stamps, and assessment number). In development is a mobile application that will be available to the public to download. The app will allow the public to inspect for proper product affixation, tax-paid, and report illicit stamps to the BIR.

APO has produced 31.2 billion excise tax stamps since 2014, with estimated tax revenues of USD 1.3 billion per year.

The Philippine government continues to enforce the excise tax stamp program to improve tax collection and reduce illicit trade. The program is also expanded to cover other products, such as liquors and sweetened beverages, in the future.